G10 FX Global Macro Fund

Minimum Investment $10,000

With A 25% Performance Fee On Profits

What We Do

Rigorous fundamental research with tactical technical analysis identifes high-conviction opportunities in G10 FX markets and related global asset classes, including equities, bonds, and commodities.

A research-led, fundamentally sound macro view.

Disciplined trade execution with firm risk controls.

Consistent engagement across changing market regimes.

Specialize in global macro strategies.

Portfolio Focus

Primarily trades G10 FX crosses and futures across the US, UK, Eurozone, Japan, Canada, and Australia. Geographic focus and asset exposure are driven by where the macro narrative is most actionable.

Leverage target of 2x–8x, max 10x, avg. ~3.5x.

Manual execution, disciplined stop losses & flexible take-profit levels.

Risk frameworks adjusted daily on market developments & conviction.

Exposure to liquid, transparent markets.

Performance Approach

This strategy demonstrates consistency over time. With careful portfolio construction, strict capital discipline and significant attention to macroeconomic signals - not high risk bets.

We do not chase returns.

We prioritize steady opportunity recognition.

We emphasize responsible risk allocation.

We commit to transparent execution.

The Team Behind the Strategy

The G10 FX Global Macro Fund is managed by two seasoned professionals:

A 35+ year veteran with deep institutional experience at UBS, Morgan Stanley, Goldman Sachs, and Commerzbank, with leadership roles across proprietary and macro trading desks.

A macro-focused portfolio manager with a background in fixed income and systematic strategies. Based in London since 2011, he also brings academic strength, currently pursuing a PhD in Finance, with research in machine learning and quantitative modelling.

Together, we bring institutional depth, tactical precision, and a shared commitment to integrity and research-led decision-making.

Invest Wisely.

Grow Confidently.

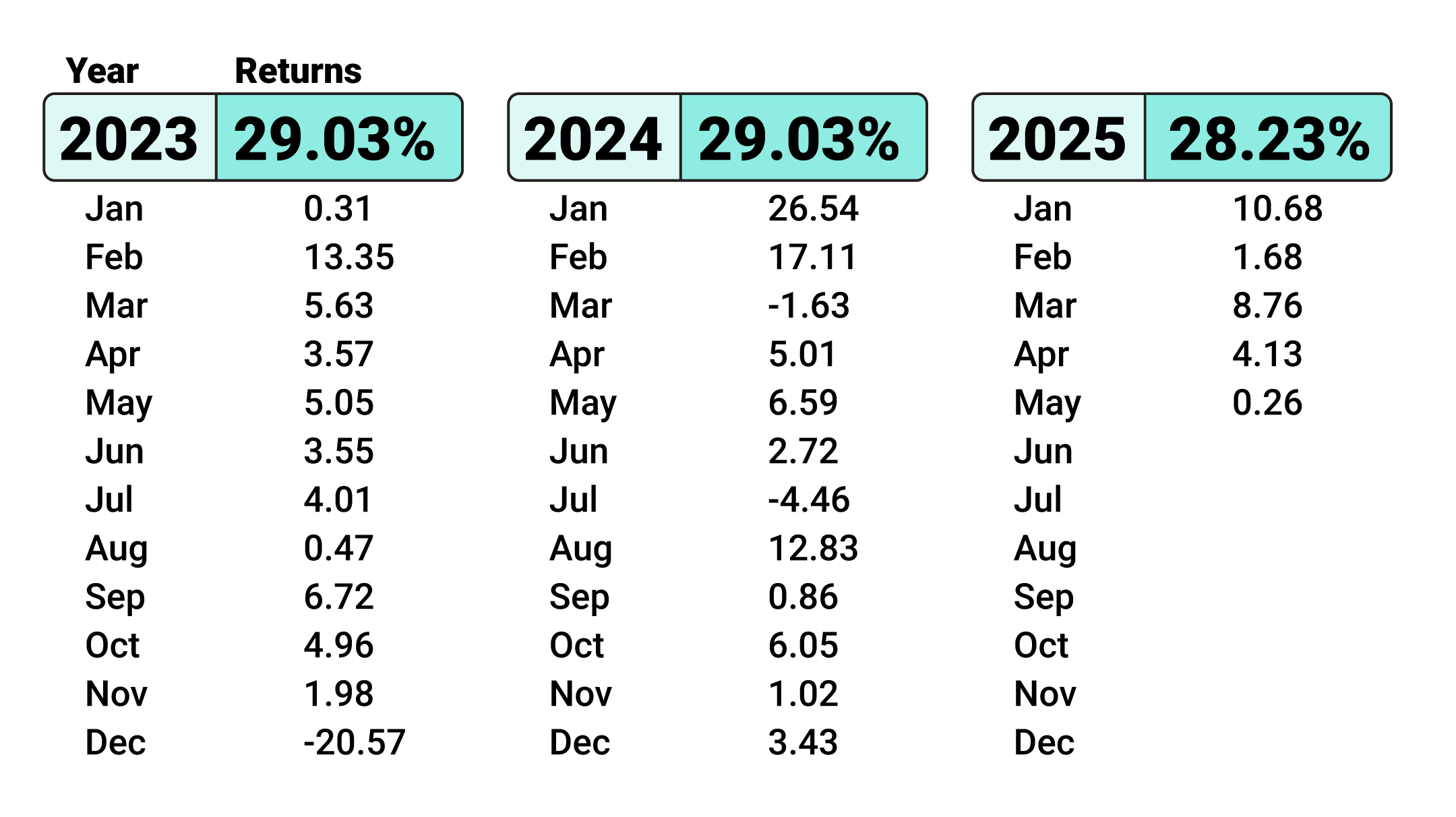

Let's Talk Numbers

Like This?

Start Investing Today